Insurance Services in Australia

Introduction

Insurance Company in Australia Definition of Insurance in its essence top car insurance Australia, is a contractual arrangement that provides financial protection or reimbursement against specified risks. It acts as a shield, ensuring that unexpected events do not translate into financial crises & Importance of Insurance Services in Australia The significance of insurance services extends beyond mere financial security. It brings a sense of assurance, allowing individuals and businesses to navigate life’s uncertainties with confidence in travel insurance in Australia.

Table of contents

- Travel Insurance Australia

- travel insurance in Australia

- car insurance Australia

- Health Insurance Australia

- Pet Insurance Australia

- Home Insurance Australia

- Kids Insurance Australia

- Mother’s Insurance Australia

- Father Insurance Australia

- Motorbike Insurance Australia

- Real Estate Insurance Australia

- Business Insurance Australia

Types of Insurance in Australia

Australia boasts a robust insurance market that offers a plethora of coverage options. From traditional forms like health and car insurance to specialized policies, the choices are diverse. Significance of Diverse Insurance Options The varied insurance options cater to the unique needs of Australians, ensuring that individuals and businesses can find tailored solutions that align with their circumstances best life insurance Australia.

Travel Insurance in Australia

Travel Insurance Australia Importance for Exploring Guide Travelers For those with a penchant for exploration, travel insurance is indispensable. It provides coverage for unexpected events, such as trip cancellations, medical emergencies, and lost belongings life insurance Australia.

Coverage Details

Travel insurance encompasses a range of benefits, including medical coverage, trip interruption protection, and coverage for personal belongings. Understanding these details is crucial for making informed decisions.

Choosing the Right Travel Insurance Plan

Selecting the appropriate travel insurance plan involves assessing individual needs, travel frequency, and destination-specific risks. A tailored approach ensures comprehensive coverage during journeys.

Navigating Car Insurance Australia

Essential for Vehicle Owners

car insurance Australia is a legal requirement in Australia, ensuring that vehicle owners are financially protected in the event of accidents or damages. Understanding the nuances of car insurance is key to compliance and comprehensive coverage.

Factors Influencing Car Insurance Rates

Several factors including the driver’s history and car vehicle type and coverage options available for Car Insurance Australia influence car insurance rates. Awareness of these factors aids in securing the most cost-effective and beneficial insurance cheapest car insurance Australia.

Tips for Finding the Best Car Insurance

Choosing the best car insurance involves comparing quotes, understanding policy features, and considering customer reviews. A thorough evaluation leads to a well-informed decision car insurance in Australia.

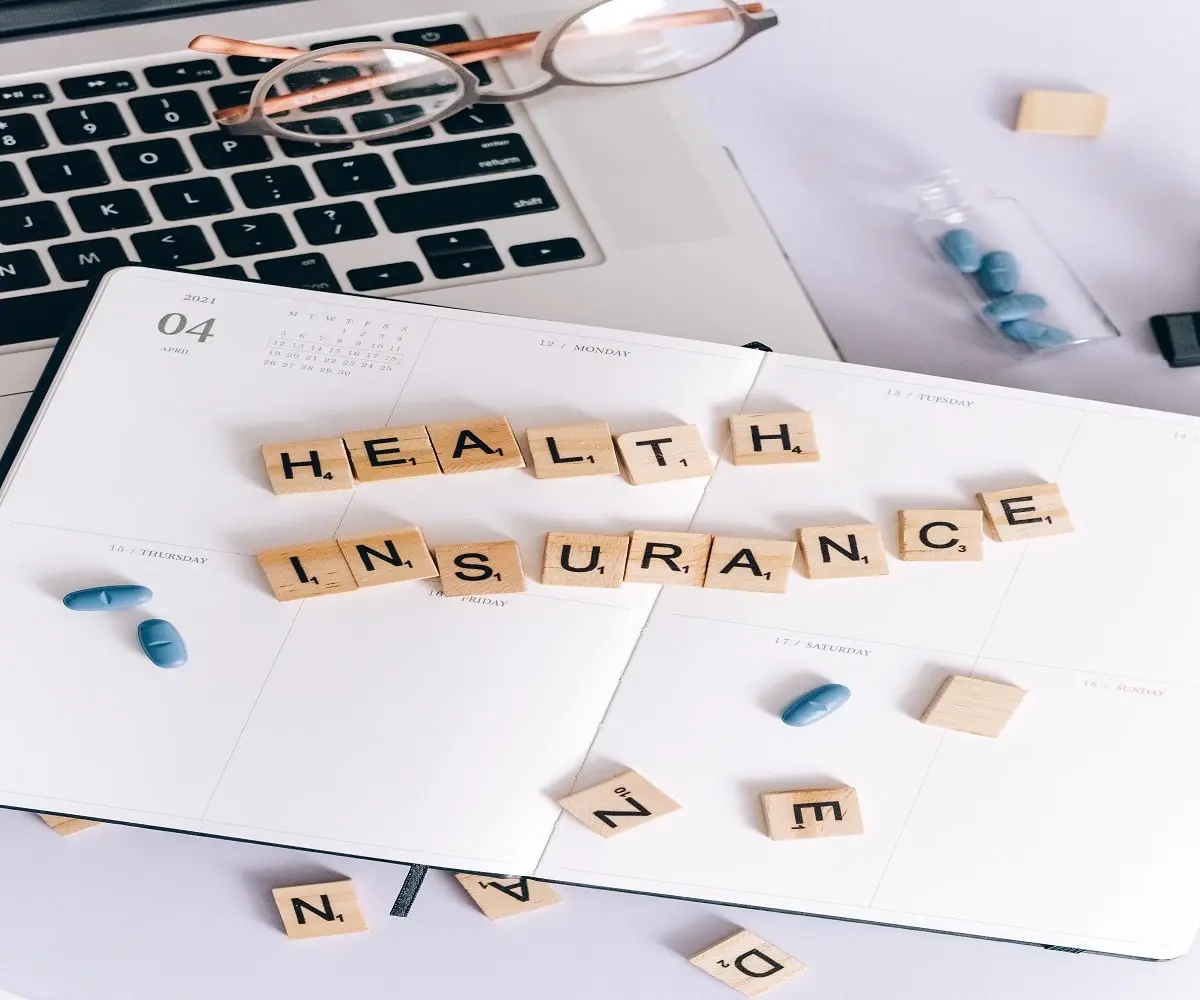

health insurance Australia

Vital for Personal Well-being

Health insurance Australia is an investment in one’s well-being. It provides financial support for medical expenses & ensures access to quality healthcare without any issue of exorbitant costs.

Key Features of Health Insurance Plans

Understanding the features of health insurance plans first must check including coverage for hospitalization, outpatient care, and preventive services, which allows individuals to select plans that align with their health needs.

How to Select the Right Health Insurance Policy

Choosing the right health insurance policy involves assessing individual health requirements, considering budget constraints, and understanding policy exclusions. A personalized approach ensures comprehensive coverage.

Pet Insurance Australia

Catering to Furry Friends

Pet Insurance Australia cherished members of the family and pet insurance companies offer a safety net for their health and well-being. It covers veterinary expenses ensuring that pets receive the care they deserve.

Coverage Options for Pet Insurance

Pet insurance comes in various forms & covers routine veterinary visits emergency required care, and even specialized treatments. Tailoring coverage to the specific needs of the pet is essential.

Understanding the Benefits for Pet Owners

Pet insurance not only eases the financial burden of veterinary expenses but also provides peace of mind, allowing pet owners to prioritize the health and happiness of their furry companions.

Home Insurance Safeguarding Your Home

Protecting Your Home Sweet Home

Home insurance is a cornerstone of homeownership have a company offering protection against damages, theft, and liabilities. It ensures that the sanctuary of the home remains secure.

Coverage Details and Considerations

Home insurance policies vary, covering structural damages, personal belongings, and even temporary living expenses. Understanding the coverage details is vital for homeowners seeking comprehensive protection.

Home Insurance Tips for Homeowners

Securing the best home insurance involves evaluating coverage needs, considering the location’s risks, and comparing policy features. A proactive approach safeguards the home against unforeseen events.

Kids Insurance Priority

Ensuring a Secure Future for Children

Kids insurance is a thoughtful investment in a child’s future secure insurance. It provides financial support for education & healthcare, and other essential needs, ensuring a secure and bright future.

Coverage Specifics for Kids Insurance

From education funds to health coverage, kids’ insurance offers a range of benefits. Understanding the specifics allows parents to make choices that align with their aspirations for their children.

Selecting the Best Insurance for Your Child

Choosing the best insurance for a child involves considering long-term goals, budget constraints, and the specific needs of the child. A tailored approach paves the way for a secure and prosperous future.

Mother’s Insurance Prioritizing Maternal

Specialized Coverage for Mothers

Maternal insurance caters to the unique needs of expectant mothers providing coverage for prenatal care, delivery, and postpartum support. It ensures a worry-free pregnancy journey.

Key Aspects of Maternal Insurance

Understanding the features of maternal insurance, including coverage for maternity-related expenses and potential complications, allows mothers to focus on the joy of motherhood without financial concerns.

Ensuring a Worry-Free Pregnancy Journey

Maternal insurance offers peace of mind, allowing expectant mothers to prioritize their health and the well-being of their unborn child. It ensures a worry-free pregnancy journey from conception to delivery.

Father Insurance Supporting Dads

Recognizing the Needs of Fathers

Father insurance acknowledges the crucial role fathers play in families. It provides coverage for various aspects of a father’s life, ensuring financial security and support.

Coverage Tailored for Fathers

From life insurance to income protection, father insurance offers a range of coverage options. Understanding the tailored benefits allows fathers to secure their family’s future with confidence.

Ensuring Financial Security for Dads

Father insurance goes beyond traditional coverage, offering financial security that extends to the well-being of the entire family. It provides fathers with the confidence to navigate life’s responsibilities.

Motorbike Insurance services

Navigating the Road with Confidence

Motorbike insurance is essential for riders offering protection against accidents, theft, and damages. It ensures that motorbike enthusiasts can enjoy the open road with confidence.

Coverage Features for Motorbike Enthusiasts

Motorbike insurance covers aspects such as liability, comprehensive damages, and even gear protection. Understanding these features helps riders choose plans that align with their biking lifestyle.

Tips for Choosing the Right Motorbike Insurance

Selecting the right motorbike insurance involves considering riding habits, bike specifications, and budget constraints. A tailored approach ensures that riders have the coverage they need on every journey.

Business Insurance Australia

Essential for Business Owners

Business insurance is a cornerstone for entrepreneurial success, offering protection against risks that can impact operations. It ensures that businesses can thrive in a dynamic market.

Coverage Considerations for Businesses

From general liability insurance to specialized coverage for industries, businesses have diverse options. Assessing coverage considerations involves understanding industry-specific risks and tailoring plans accordingly.

Mitigating Risks through Comprehensive Business Insurance

Comprehensive business insurance mitigates risks, allowing business owners to focus on growth and innovation. It provides a safety net against unforeseen challenges that can impact the continuity of operations.

Real Estate Insurance Investments

Securing Property Assets

Real estate insurance is essential for property owners is safeguard investments against damages, liabilities, and unforeseen events. It ensures that real estate remains a valuable asset.

Coverage Options for Real Estate Insurance

From landlord insurance to coverage for commercial properties, real estate insurance comes in various forms. Choosing the right coverage involves assessing property specifics and potential risks.

Maximizing Protection for Property Owners

Property owners can maximize protection by understanding coverage limits, policy exclusions, and potential risks associated with their real estate. A proactive approach safeguards property investments.

Conclusion

Recap of the Importance of Insurance Insurance, in its myriad forms, plays a pivotal role in safeguarding individuals, families, and businesses. The diverse options cater to unique needs, ensuring that Australians can face the future with confidence. Tailoring Insurance Choices to Individual Needs The key to maximizing the benefits of insurance lies in tailoring choices to individual needs. Whether it’s personal insurance or coverage for businesses, a customized approach ensures optimal protection.

Frequently Asked Questions (FAQs)

1- What Factors Influence Insurance Premiums?

Answer: Insurance premiums are influenced by factors such as age, coverage type, and individual risk factors. Understanding these factors helps individuals make informed decisions.

2- How Can One Find Affordable Insurance Options?

Answer: Finding affordable insurance involves comparing quotes, exploring discounts, and understanding policy features. Taking a proactive approach ensures cost-effective coverage.

3- Is It Necessary to Have Multiple Insurance Policies?

Answer: While bundling insurance policies can offer convenience and potential discounts, it’s essential to assess individual needs. Having multiple policies may be beneficial, but it should align with specific requirements.

4- What Should Be Considered When Selecting Health Insurance?

Answer: When selecting health insurance, individuals should consider factors such as coverage for pre-existing conditions, network of healthcare providers, and out-of-pocket costs. Tailoring the plan to health needs is crucial.

5- How Does Insurance Contribute to Financial Security?

Answer: Insurance contributes to financial security by providing a safety net against unexpected expenses. It ensures that individuals and businesses have the necessary funds to recover from unforeseen events.